The Milan Night Chart, often referred to as the “MNC,” is a specialized technical analysis tool that has gained significant popularity among traders and investors in the financial markets. This unique chart pattern, developed in the city of Milan, Italy, offers a unique perspective on market dynamics and can provide valuable insights for making informed trading decisions.

In this comprehensive guide, we will delve into the intricacies of the Milan Night Chart, exploring its history, significance, and practical applications. You will learn how to read and interpret this chart, identify key patterns and trends, and leverage it as a powerful tool in your trading arsenal. Whether you’re a seasoned trader or new to the world of technical analysis, this article will equip you with the knowledge and skills to harness the power of the Milan Night Chart for your investment success.

Understanding the Milan Night Chart

The Milan Night Chart is a specialized technical analysis tool that was developed in the financial hub of Milan, Italy. This chart pattern is designed to provide traders with a unique perspective on market movements, offering insights that may not be readily apparent in traditional candlestick or line charts.

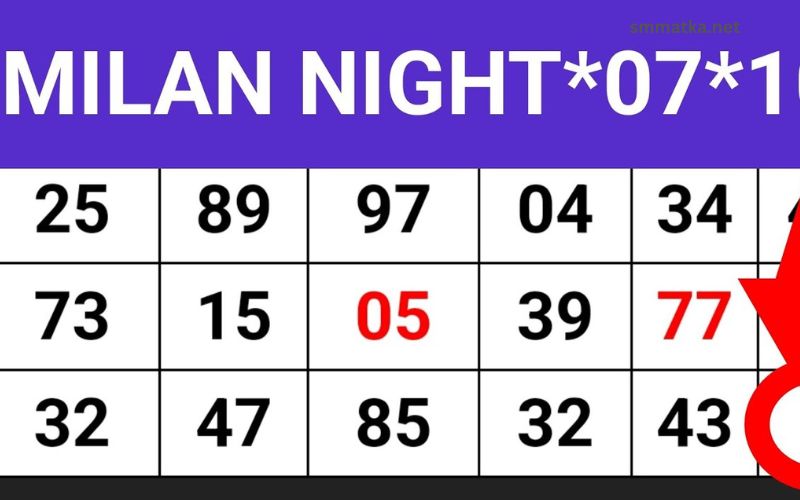

At its core, the Milan Night Chart is a graphical representation of the market’s activity during the overnight trading session, typically between the close of the previous trading day and the open of the current trading day. By focusing on this specific time frame, the MNC aims to capture the subtle shifts and dynamics that occur in the markets when most market participants are not actively trading.

The Milan Night Chart is characterized by its distinct visual appearance, which often resembles a series of overlapping “night” shapes or patterns. These patterns can provide valuable information about market sentiment, volatility, and potential future price movements.

Milan Night Chart History and Significance

The origins of the Milan Night Chart can be traced back to the late 1980s, when a group of Italian traders and market analysts observed that the overnight trading session often exhibited unique patterns and behaviors that were not fully captured by traditional technical analysis tools.

These early pioneers of the MNC recognized the potential for this chart pattern to offer valuable insights into market dynamics, and they began to develop and refine the methodology for interpreting and applying the Milan Night Chart.

Over the years, the Milan Night Chart has gained widespread recognition and adoption among traders and investors around the world. Its ability to provide a unique perspective on market activity, particularly during the often-overlooked overnight trading session, has made it a valuable tool in the arsenal of many successful traders.

Today, the Milan Night Chart is used by traders and analysts across various asset classes, including stocks, currencies, commodities, and derivatives. Its significance lies in its ability to identify potential market turning points, detect emerging trends, and inform trading strategies that capitalize on the nuances of overnight market movements.

How to Read the Milan Night Chart

Reading and interpreting the Milan Night Chart requires a specific set of skills and knowledge. Here’s a step-by-step guide to help you understand the key elements of this technical analysis tool:

- Chart Structure: The Milan Night Chart is typically displayed as a series of overlapping “night” shapes or patterns, each representing the market’s activity during a specific overnight trading session.

- Time Frame: The MNC focuses on the overnight trading session, which is typically defined as the period between the close of the previous trading day and the open of the current trading day.

- Price Movement: The vertical axis of the chart represents the price movement, with the top and bottom of each “night” shape indicating the high and low prices, respectively, during the overnight trading session.

- Volume: While volume is not a primary focus of the Milan Night Chart, the width of each “night” shape can provide some insight into the trading activity and liquidity during the overnight session.

- Patterns and Trends: The specific shapes and patterns formed by the overlapping “night” shapes can reveal important information about market sentiment, volatility, and potential future price movements.

- Trend Identification: By analyzing the overall shape and direction of the Milan Night Chart, you can identify emerging trends and potential support or resistance levels.

- Confluence with Other Indicators: While the Milan Night Chart is a powerful tool on its own, it is often used in conjunction with other technical analysis indicators and strategies to provide a more comprehensive view of the market.

As you become more familiar with the Milan Night Chart, you’ll develop a keen eye for identifying the subtle nuances and patterns that can provide valuable insights into the market’s behavior.

Milan Night Chart Patterns and Trends

The Milan Night Chart is characterized by a variety of distinct patterns and trends that can provide valuable information to traders and investors. Here are some of the most common patterns and trends you may encounter when analyzing the MNC:

- Bullish Patterns:

- “Rising Staircase”: A series of overlapping “night” shapes that gradually ascend, indicating a bullish trend.

- “Inverted Hammer”: A single “night” shape with a long upper wick, suggesting a potential bullish reversal.

- Bearish Patterns:

- “Falling Staircase”: A series of overlapping “night” shapes that gradually descend, indicating a bearish trend.

- “Shooting Star”: A single “night” shape with a long upper wick, suggesting a potential bearish reversal.

- Consolidation Patterns:

- “Symmetrical Triangle”: A series of overlapping “night” shapes that form a symmetrical triangle pattern, indicating a period of consolidation.

- “Ascending/Descending Triangle”: A series of overlapping “night” shapes that form a triangular pattern, with one side sloping upward and the other downward, suggesting a potential breakout.

- Trend Continuation Patterns:

- “Flagpole and Flag”: A series of overlapping “night” shapes that form a “flagpole” followed by a “flag” pattern, indicating a continuation of the existing trend.

- “Pennant”: A series of overlapping “night” shapes that form a narrow, symmetrical pattern, suggesting a continuation of the current trend.

- Reversal Patterns:

- “Double Top/Bottom”: A series of overlapping “night” shapes that form a distinct double top or double bottom pattern, indicating a potential trend reversal.

- “Head and Shoulders”: A series of overlapping “night” shapes that form a distinct head and shoulders pattern, signaling a potential trend reversal.

By familiarizing yourself with these common patterns and trends, you’ll be better equipped to analyze the Milan Night Chart and make informed trading decisions.

Tips for Using the Milan Night Chart for Predictions

To effectively leverage the Milan Night Chart for making accurate predictions, consider the following tips:

- Understand Market Dynamics: Develop a deep understanding of the underlying factors that influence market behavior, particularly during the overnight trading session. This will help you better interpret the patterns and trends observed in the Milan Night Chart.

- Combine with Other Indicators: While the Milan Night Chart is a powerful tool on its own, it is often most effective when used in conjunction with other technical analysis indicators, such as moving averages, oscillators, and volume indicators. This can provide a more comprehensive view of the market.

- Identify Key Support and Resistance Levels: Analyze the Milan Night Chart to identify potential support and resistance levels, which can be used to inform your trading decisions and risk management strategies.

- Monitor Trend Strength and Momentum: Pay close attention to the overall shape and direction of the Milan Night Chart, as well as the strength and momentum of the observed trends. This can help you anticipate potential trend changes or reversals.

- Recognize Patterns and Formations: Familiarize yourself with the common patterns and formations observed in the Milan Night Chart, such as the “Rising Staircase” or “Falling Staircase.” These can provide valuable insights into market sentiment and potential future price movements.

- Backtest and Validate Your Strategies: Before implementing your trading strategies based on the Milan Night Chart, thoroughly backtest them using historical data to validate their effectiveness and identify any potential weaknesses or limitations.

- Stay Adaptable and Flexible: The financial markets are constantly evolving, and the significance and interpretation of the Milan Night Chart may change over time. Remain open-minded and adaptable in your approach, and be willing to adjust your strategies as market conditions and dynamics shift.

By following these tips and continuously refining your understanding of the Milan Night Chart, you can increase your chances of making accurate predictions and achieving consistent trading success.

Common Mistakes to Avoid When Using the Milan Night Chart

While the Milan Night Chart can be a powerful tool for traders and investors, it’s important to be aware of some common mistakes that can lead to suboptimal results. Here are some pitfalls to avoid when using the MNC:

- Overreliance on the Milan Night Chart: The Milan Night Chart should not be the sole basis for your trading decisions. It is essential to combine it with other technical and fundamental analysis tools to gain a more comprehensive understanding of the market.

- Misinterpreting Patterns and Trends: Accurately identifying and interpreting the patterns and trends in the Milan Night Chart requires a deep understanding of market dynamics and technical analysis principles. Misinterpreting these patterns can lead to costly trading errors.

- Failing to Adapt to Market Changes: The financial markets are constantly evolving, and the significance and interpretation of the Milan Night Chart may change over time. Failing to adapt your strategies and approach can lead to suboptimal performance.

- Ignoring Confirmation from Other Indicators: While the Milan Night Chart can provide valuable insights, it’s important to seek confirmation from other technical and fundamental indicators before making trading decisions. Relying solely on the MNC can increase the risk of false signals.

- Insufficient Risk Management: Effective risk management is crucial when using the Milan Night Chart. Failing to set appropriate stop-loss levels, position sizes, and other risk management measures can expose you to unnecessary losses.

- Emotional Trading: The Milan Night Chart can sometimes be subject to subjective interpretation, which can lead to emotional trading decisions. It’s essential to maintain a disciplined, objective approach and avoid letting emotions cloud your judgment.

- Lack of Backtesting and Validation: Before implementing your trading strategies based on the Milan Night Chart, it’s crucial to thoroughly backtest them using historical data to validate their effectiveness and identify any potential weaknesses or limitations.

By being aware of these common mistakes and taking proactive steps to address them, you can increase your chances of successfully incorporating the Milan Night Chart into your trading arsenal and achieving consistent, long-term success.

Milan Night Chart Analysis Tools and Software

To effectively analyze and interpret the Milan Night Chart, traders and investors can leverage a variety of specialized tools and software. Here are some of the most popular options:

- Dedicated MNC Software: There are several software platforms and applications specifically designed for analyzing the Milan Night Chart. These tools often include features like pattern recognition, trend analysis, and backtesting capabilities.

- Charting Platforms: Many popular charting platforms, such as TradingView, MetaTrader, and NinjaTrader, offer the ability to display and analyze the Milan Night Chart alongside other technical indicators and tools.

- Custom Indicators and Scripts: Some traders and analysts have developed custom indicators or scripts that can be integrated into their preferred charting platforms to enhance the functionality and visualization of the Milan Night Chart.

- Data Feeds and Historical Data: Accessing accurate and up-to-date market data, particularly for the overnight trading session, is crucial for effective Milan Night Chart analysis. Look for reliable data providers that offer comprehensive historical data and real-time feeds.

- Automated Trading Systems: Some traders have developed automated trading systems that incorporate the Milan Night Chart as a key component of their decision-making process. These systems can help to reduce the emotional and cognitive biases that can sometimes affect manual trading decisions.

- Education and Training Resources: To fully leverage the power of the Milan Night Chart, it’s important to continuously expand your knowledge and skills. Look for educational resources, such as online courses, webinars, and trading communities, that specialize in the MNC and its application.

By utilizing these specialized tools and resources, you can enhance your ability to analyze, interpret, and act on the insights provided by the Milan Night Chart, ultimately improving your trading performance and decision-making.

Milan Night Chart Strategies for Success

To successfully incorporate the Milan Night Chart into your trading arsenal, consider the following strategies:

- Develop a Comprehensive Understanding: Dedicate time to thoroughly understanding the underlying principles, patterns, and trends of the Milan Night Chart. This will enable you to make more informed and confident trading decisions.

- Combine with Other Indicators: Leverage the Milan Night Chart in conjunction with other technical analysis tools, such as moving averages, oscillators, and volume indicators. This can provide a more holistic view of the market and help you identify potential trading opportunities.

- Backtest and Validate Your Strategies: Before implementing your trading strategies based on the Milan Night Chart, conduct thorough backtesting using historical data. This will help you identify the strengths and weaknesses of your approach, allowing you to refine and optimize your strategies.

- Monitor Market Dynamics: Continuously monitor and analyze the underlying factors that influence market behavior, particularly during the overnight trading session. This will help you better interpret the patterns and trends observed in the Milan Night Chart.

- Develop Disciplined Risk Management: Implement robust risk management practices, such as setting appropriate stop-loss levels, position sizing, and portfolio diversification. This will help you mitigate the potential downside risks associated with your trading decisions.

- Stay Adaptable and Flexible: The financial markets are constantly evolving, and the significance and interpretation of the Milan Night Chart may change over time. Remain open-minded and adaptable in your approach, and be willing to adjust your strategies as market conditions and dynamics shift.

- Seek Ongoing Education and Collaboration: Continuously expand your knowledge and skills by engaging with educational resources, trading communities, and industry experts who specialize in the Milan Night Chart and its application.

By following these strategies and continuously refining your approach, you can increase your chances of successfully incorporating the Milan Night Chart into your trading toolkit and achieving consistent, long-term success in the financial markets.

Conclusion

The Milan Night Chart is a powerful and unique technical analysis tool that provides traders and investors with a valuable perspective on market dynamics, particularly during the overnight trading session. By understanding the history, significance, and practical application of the MNC, you can gain valuable insights that can inform your trading decisions and help you navigate the complexities of the financial markets.

As you continue to explore and apply the Milan Night Chart, remember to remain adaptable, disciplined, and open-minded. Combine it with other technical and fundamental analysis tools, maintain a robust risk management strategy, and continuously seek out new opportunities to expand your knowledge and skills.

To take your trading to the next level with the Milan Night Chart, sign up for our comprehensive training program today. Our expert-led courses and interactive workshops will equip you with the knowledge and practical skills needed to effectively incorporate the MNC into your trading strategies. Don’t miss this opportunity to gain a competitive edge in the markets – enroll now!